Every market has a story. This is Miami’s. While attending the South Florida Real Estate Forum, we gathered insights into how current challenges for developers are creating golden opportunities for investors and brokers. Let’s dive in.

Silver linings in a distressed multifamily market

Like other markets across the country, South Florida is feeling the impact of inflation in the multifamily housing space. Here are some of the biggest factors affecting developers right now.

- Rising interest rates make financing multifamily projects difficult, causing loan defaults and stalled projects.

- High building costs render affordable housing projects financially unsustainable.

- The demand for luxury units drives up costs, reducing profit margins.

- Subcontractor shortages affect the quality of construction work.

- Red tape interferes with the conversion of multifamily buildings into condominiums.

While developers are facing challenges, investors recognize that it’s time to make their move. Lenders are hesitant to take back distressed multifamily assets, which means investors can acquire these properties at 20%-30% below replacement costs. As the market stabilizes and interest rates fall, these investments could yield significant returns in the future.

Renter populations on the move

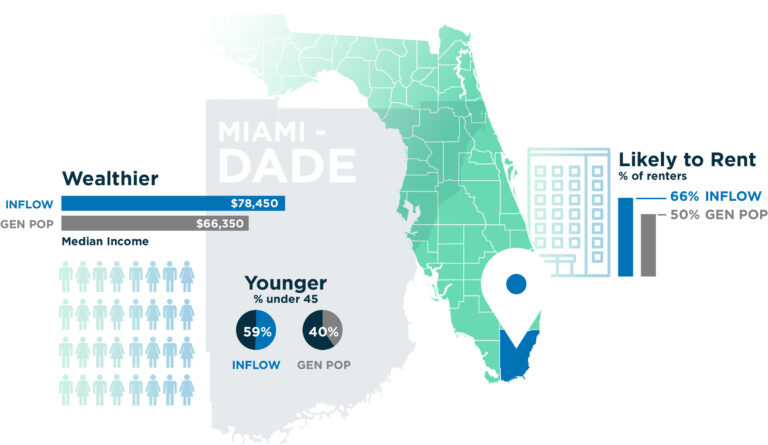

Despite inflation and interest rates, CENSAI data shows positive migration trends over the last 12 months in South Florida’s biggest counties, including Miami-Dade. Inflows are younger, wealthier, and more likely to be renters compared to both the general population and outgoing population.

Looking at the top 10 inflows for Miami-Dade County, we see that most people came from New York City, Los Angeles, and other Florida markets. Additional insights reveal more about why this market is hot. Large numbers of people are also coming from Latin America. Local governments are working with brokers and developers to promote Miami as a great place to live, work, and invest. Its urban design, walkability, vibrant culture, and quality of life continue attracting developers of high-quality multifamily projects.

Meeting the need for better market data

Brokers play a vital role in helping investors and developers discover real estate opportunities across South Florida. They are eager for the latest population data, detailed demographics, and highly customized reporting. As it turns out, CENSAI checks all those boxes.

Migration analytics and projections

The need for comprehensive migration data is growing, especially for understanding inflows and outflows to affordable markets. Real estate professionals increasingly rely on tools for analyzing current migration trends, predicting future patterns, and segmenting audiences by income, education, profession, and other demographic attributes.

Targeting renters versus buyers

Brokers and agents are looking at renters who may be interested in purchasing homes. Audience segmentation — for example, renters from specific markets or demographics — provides valuable insights for effectively targeting potential buyers.

Market reports and analytics

There’s also strong interest from brokers and developers in demographic categories such as renter/owner status, household income, and education level. Detailed demographic insights help real estate professionals identify emerging buyer segments, support better-informed decisions, and tailor their marketing strategies.

Industry-leading population intelligence

Developers, brokers, and investors need the best data available to guide their decisions. One of the ways we meet that need is CENSAI for Miami Realtors®, a dashboard featuring detailed insights into South Florida markets. CENSAI for Miami Realtors® offers granular levels of demographics and migration patterns. If missed your chance to discover it at The Real Deal’s latest conference, it’s not too late.